Scott Morrison and Josh Frydenberg knew they had to upend their previous reluctance to provide wage subsidies. And they have, big time.

Jennifer HewettColumnist

Mar 30, 2020 – 6.03pm

NAB’s chief executive Ross McEwan acknowledges the startling new reality dominating every waking hour – and the many sleepless nights – of governments, bankers and all other business owners.

“There is no playbook for this,” he says.

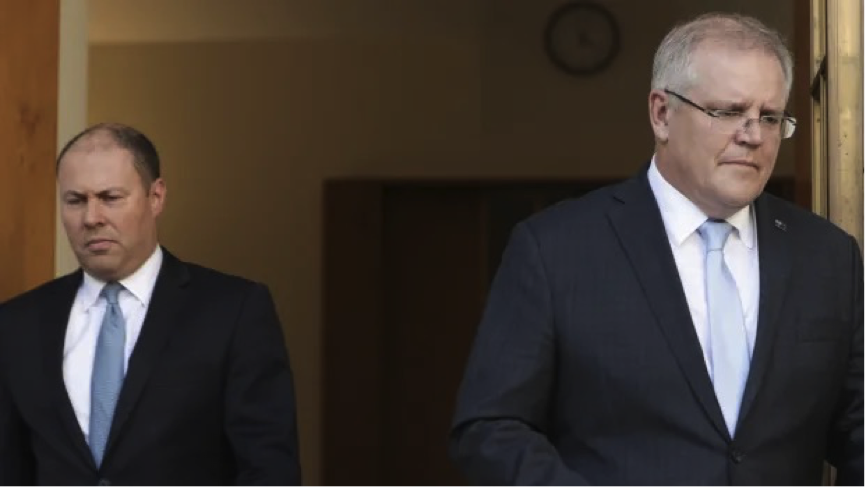

Playing catch-up: Scott Morrison and Josh Frydenberg are making multibillion-dollar decisions in an environment which grows more uncertain by the day. Alex Ellinghausen

Instead, the constant risk has been the play is moving far too quickly for the latest rules of engagement to be sufficiently effective to cushion escalating carnage.

This column does not underestimate the pressure or the demands on governments and businesses trying to operate at speed to deliver actions deemed unfathomable just a month ago.

But too often, the notion of “whatever it takes” in terms of new government assistance has already had to be translated into “too little too late” within a week or so. Doing more with more – rather than with less – goes counter to traditional Treasury thinking, of course. Still, the risk of underspending in the face of such an avalanche of destruction seems greater than that of excessive expenditure.

So the government’s announcement on Monday was for a huge $130 billion economic package in order to subsidise wages over six months. This is a truly massive spend and should help shore up the economy as well as restoring a degree of consumer and business confidence about the immediate financial future.

It is already under fire for being too low to help the problem it seeks to address.

Morrison has gone from calling the newest government measure a “bridge” to the other side to an “economic lifeline” for up to 6 million Australians to make it through the coronavirus crisis.

It will provide employees $1500 a fortnight, paid via their employers through the ATO, in a new “jobkeeper” payment. That adds up to $39,000 a year, backdated to March 30 and payable from May, for full-time and part-time employees and sole traders as well as casuals with the same employer for at least a year. It will also apply to those people stood down from March 1. The threshold for businesses is to have lost 30 per cent of their revenue over a month or 50 per cent for those with previous revenue of over $1 billion.

The government says this version of wages subsidy is more generous than that offered by New Zealand and broader than the arrangements on offer in the UK.

Yet it is already under fire, including friendly fire from some business leaders, for being too low to help the problem it seeks to address; that is, giving businesses enough space to hold onto most of their staff despite the collapse of revenue and cash flow, while providing individuals sufficient shelter from the trauma of unemployment or financial ruin.

“Some will say it is too little, some will say it is too much,” Morrison acknowledged.

Crucial role for banks

Will it be enough? The Prime Minister insists it is a uniquely Australian solution and based on enduring national values and principles. In particular, that includes the flat rate of payment rather than a percentage to avoid previously higher-paid people getting more assistance.

Treasurer Josh Frydenberg also points out that for many people in the sectors hardest hit in retail, hospitality and tourism, the payment will add up to close to 100 per cent of their previous minimum wages.

Canberra’s desperate hope is that people will stay connected to their previous employers even if the businesses do close. But the government aim is for the payment to also allow many more businesses to stay open and keep employees working – to some extent at least.

Getting an impossible balance as right as possible doesn’t just require extraordinarily difficult judgments by governments about what is required. The approach of the banks will also be crucial.

And while Australia’s big banks are deeply empathetic to the plight of their business customers, big and small, they are still sending a tough message to some. The banks won’t be able to save everyone. It is going to be about assessing and assisting those with the best chance of surviving the sudden onset of immediate and massive financial haemorrhaging.

ANZ chief executive Shayne Elliott told The Australian Financial Review Banking & Wealth Summit crisis briefing on Monday that about 10 per cent of the bank’s 130,000 small business customers have sought the six-month deferral of interest and principal payments now available. Ross McEwan estimates the figure to be about 8 per cent of NAB’s business customers. But that is only so far.

The bankers know the extraordinary speed and size of that change over the past week will only accelerate over the next few weeks. Using the now familiar language of the health crisis, Elliott says the aim is to try to “isolate” the spread of infection as much as possible by limiting the amount of problems in one area flowing through to another.

Community and political scepticism about the big banks for being too big, too dominant, too profitable has been abruptly replaced by relief their balance sheets and mindsets are in relatively good shape to provide crucial life support for stricken businesses and households.

According to McEwan, NAB will prioritise existing customers and continue to support good businesses while still protecting the bank’s balance sheet. But he also makes the point that his experience in the UK has shown it is better to be honest with customers that were already struggling “sooner rather than later”.

Banking leaders generally support the Morrison government’s moves to progressively ramp up assistance, including the abrupt about-turn on the need for wage subsidies to partially insulate businesses and individual incomes being lost.

According to the CBA’s Matt Comyn, providing an incentive for businesses to pay employees is essential given the importance of maintaining connection.

“So that when we come out of these containment measures, hopefully large parts of the economy can be stood up relatively quickly,” he told the Summit.

Hopefully.

Source:https://www.afr.com/companies/financial-services/scott-morrison-s-130b-bet-20200330-p54fbh